Meta Shareholder Proposal to Put Bitcoin on the Balance Sheet

In an exciting move for the Bitcoin community, a group of Meta shareholders recently submitted a proposal urging the tech giant to allocate a portion of its balance sheet to Bitcoin. This initiative reflects growing momentum among corporations to consider Bitcoin as a strategic reserve asset, offering a hedge against inflation and a potential gateway to broader innovation in the digital economy.

Why Bitcoin?

As the world's largest decentralized cryptocurrency, Bitcoin has emerged as a store of value with unique properties. Its fixed supply, 24/7 365 days per year liquidity, decentralization and separation of money and state make it an attractive option for companies seeking to diversify their reserves beyond traditional fiat and government bonds in these high inflation times.

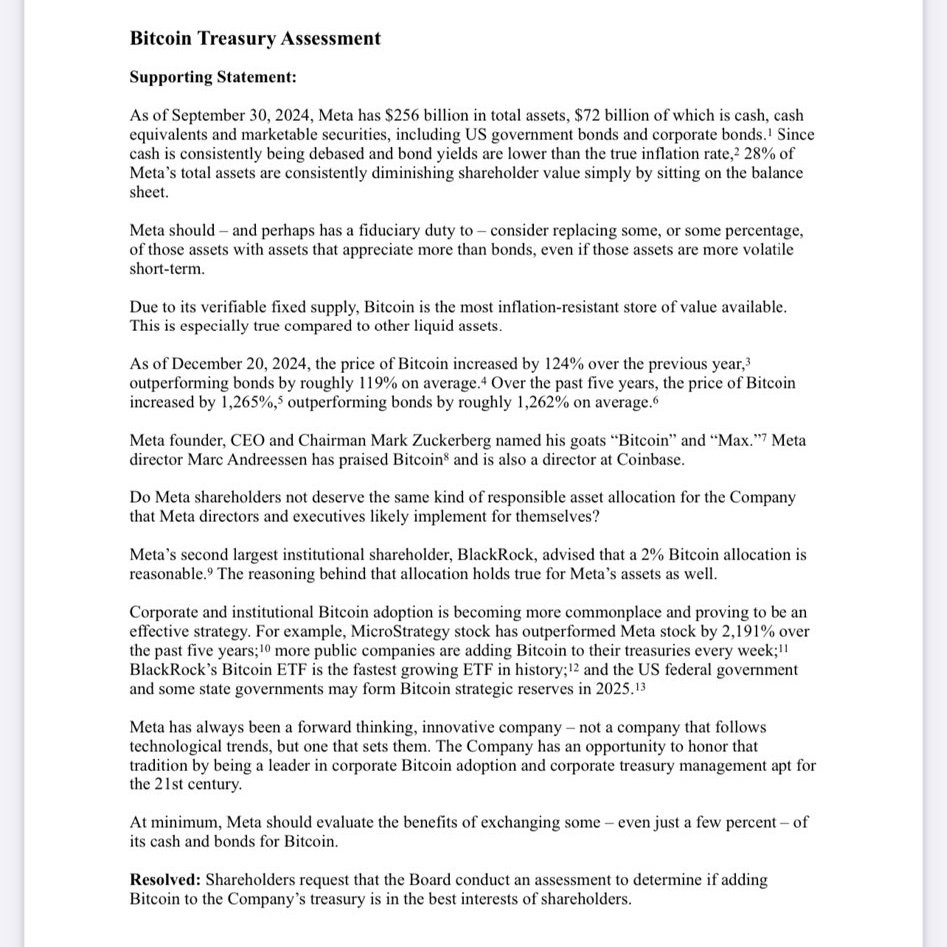

Shareholders backing the proposal have highlighted Bitcoin's exceptional performance compared to other assets:

Outstanding Returns: Over the past 12 months, Bitcoin has delivered a remarkable 124% return, significantly outperforming bonds, which returned just 5%. Over the past five years, Bitcoin has achieved a staggering 1265% return, outpacing bonds by a massive 1262%.

Inflation Resistance: Bitcoin’s fixed supply makes it the most inflation-resistant asset, a critical factor in preserving wealth in uncertain economic conditions.

Corporate Success Stories: MicroStrategy, a company that has embraced Bitcoin on its balance sheet, has outperformed Meta’s stock by an incredible 2,191% over the past five years, demonstrating the potential upside of integrating Bitcoin into corporate strategy.

The Case for Meta

Meta's robust balance sheet and market influence position it perfectly to benefit from Bitcoin adoption. Holding Bitcoin could provide:

Inflation Hedge: Protecting Meta’s cash reserves from devaluation in an inflationary environment.

Strategic Advantage: Aligning with emerging trends in decentralized finance (DeFi) and the broader digital asset ecosystem.

Increased Shareholder Value: Unlocking new value opportunities through Bitcoin's long-term appreciation potential.

A Reputation Repair Opportunity

Beyond financial benefits, adopting a Bitcoin treasury strategy could also provide Meta with a unique opportunity to address long-standing criticisms of its business practices. Over the years, CEO Mark Zuckerberg has faced intense scrutiny for Meta’s role in censorship and the surveillance of its users - especially during covid madness when Zuckerberg censored doctors, nurses and doctors who rightly questioned the authoritarian measures taken by government and businesses.

A bold move toward Bitcoin—an asset rooted in decentralization, transparency, and individual empowerment—would align Meta with values that directly counter these criticisms. This could serve as a step toward mending Zuckerberg’s tattered reputation and rebranding Meta as a forward-thinking, user-focused organization.

Zuckerberg’s Personal Bitcoin Connection

Interestingly, Zuckerberg has hinted at a personal connection to Bitcoin. In 2021, he shared a photo on social media of his goats, humorously named Max and Bitcoin. This sparked widespread speculation that Zuckerberg may personally hold a significant amount of Bitcoin.

Adding fuel to the fire, many believe Zuckerberg is determined not to let the Winklevoss twins—his long-time rivals and prominent Bitcoin investors—own more Bitcoin than he does. If true, this personal stake could further align Zuckerberg’s interests with the adoption of a Bitcoin treasury strategy for Meta.

Zuckerberg Holds the Keys

Mark Zuckerberg’s control of Meta goes beyond his CEO title. Through his ownership of 13.6% of Meta’s total shares, which carry 57% of the voting power, Zuckerberg has the ability to single-handedly approve Bitcoin as part of the company’s balance sheet strategy. This level of influence means that if he believes in Bitcoin’s potential—and his past hints suggest he might—he could swiftly turn a shareholder proposal into reality.

This concentrated power could enable Meta to make a transformative decision, positioning it as a leader in corporate Bitcoin adoption and bolstering its reputation in the process.

Challenges Ahead

While the proposal is exciting, it faces hurdles. Meta’s leadership and board will need to weigh the volatility of Bitcoin against its long-term potential. Regulatory concerns and public perception will also play significant roles in shaping the outcome of this proposal.

A Sign of the Times

This proposal reflects the broader movement of institutional adoption of Bitcoin. With companies like Tesla, Block and MicroStrategy already leading the way, the possibility of Meta joining the ranks could further legitimize Bitcoin as a corporate reserve asset.

Whether Meta ultimately takes this leap or not, one thing is clear: Bitcoin is no longer on the fringe. It's increasingly becoming a cornerstone of modern financial strategy. For shareholders and enthusiasts alike, this proposal is a bold step toward bridging the gap between the digital asset revolution and mainstream corporate finance.

Stay tuned to see how this unfolds—2025 is increasingly looking like the year Bitcoin breaks further into the Mag 7.